The budget battles Is discussion possible?

#501

Posted 2011-July-30, 09:20

To ask the president to submit a plan to get the tea party crazies to do what they should have done in the first place is sheer lunacy.

The infliction of cruelty with a good conscience is a delight to moralists — that is why they invented hell. — Bertrand Russell

#502

Posted 2011-July-30, 09:27

Yet since they started this standoff on the debt ceiling (and they really did start it, such votes were never controversial before), the stock market has tanked which cost me thousands of dollars. The likely result of this is to hurt investor confidence in the US, which will raise interest rates and cost me several thousand dollars a year. And the main thing Republicans seem to want in the negotiations (that Democrats have refused to give them) is substantial cuts to medicare, which will cost my parents several thousand a year to maintain their health coverage.

How is this not a tax hike? Sure they may not call it that, but it seems to me that if the government's partisan bickering is directly costing me money that's effectively the same thing. And an honest-to-god tax hike might at least help the country dig its way out of this debt, whereas the interest rate hike coming because of this stupidity will actually make the debt worse because the government will have to pay a higher interest rate too, while also taking money out of the pocket of every American who has a mortgage or a student loan or a 401(k) plan.

And has anyone noticed how the job market has stalled the last few months, since the "debt ceiling standoff" really heated up? Through early this year, we were gaining six-figure jobs a month. Sure, that was barely treading water with population growth, but it was a heck of a lot better than what's happening now.

It seems to me that Republicans won the last election because the Democrats cut medicare (which people didn't like) and because the job market stinks (which people definitely don't like). So now the Republicans are engaging in this ridiculous partisan battle where their main goal is... massive medicare cuts. And by engaging in the partisan battle they are doing exactly what they accuse Obama of doing to kill jobs (creating uncertainty in the economy so that businesses refuse to invest) and also bringing about a de facto tax hike for most of the country.

a.k.a. Appeal Without Merit

#503

Posted 2011-July-30, 10:01

The following quote from Bruce Bartlett is simply a preemptive shot to stall any claim that gross revenues increased and thus the Bush tax cuts were a success.

Quote

Simply restoring taxes to the pre-Bush level would add an immense amount of revenues to the coffers. To hold the country hostage only to provide the most wealthy individuals and corporations continued tax breaks that they have not in 10 years shown a willingness to put back into expanding the economy is corruption of the small-government, free-market ideology: it is simply profit/wealth protectionism.

The chart shows that over 8 years revenues that equated to 23.9 percent of GDP versus 2000 levels were lost to tax breaks. With a $15 trillion economy, this amount comes to around $3.5 trillion, or almost the total amount of reductions now being debated as necessary.

#504

Posted 2011-July-30, 11:07

PassedOut, on 2011-July-30, 09:20, said:

PassedOut, on 2011-July-30, 09:20, said:

congress would agree with you... clinton (and maybe obama) would not

Quote

unrelated as in, cut spending? as in, no free lunch?

Quote

yes, far better if he invokes the 14th and simply does it himself

#505

Posted 2011-July-30, 11:45

Quote

Of course, Epps admits, a move like this would represent a major assertion of executive power. Moreover, conservative Supreme Court Justices, no matter their past views, would have to reckon with a Democratic president ignoring a Republican House and ruling that he was able to do so with their blessing. Many of the legal scholars I spoke to expressed skepticism that Scalia and the conservative wing of the Court could be expected to go to bat for the Obama administration when it comes to the question of standing, as well as the broad conception of executive powers. Tiefer, however, was more optimistic: “I, for one, think that conservatives on the Court are faithful to their conservative principles of jurisdiction and they don’t alter them merely because on the merits they might be partial to one side.” If the Obama administration chooses to ignore the debt ceiling, they’ll have to hope he’s right.

Of course, the issue is whether or not President Obama is courageous enough to take responsibility for a non-default if the Congress won't do its job.

#506

Posted 2011-July-30, 11:51

#507

Posted 2011-July-30, 12:13

Quote

I would hope that no one seriously buys into this Republican talking point that uncertainty is stalling capital investment - that is a ludicrous claim. Capital investment is created by demand. The issue with our economy is a demand problem, not an uncertainty problem. Without demand, there will never be enough jobs. Demand is the product of wages. Without increased wages, demand will always lag.

Without the manufacturing base, educational investment will have to procede any increase in wages. This will necessitate a long road back to economic health.

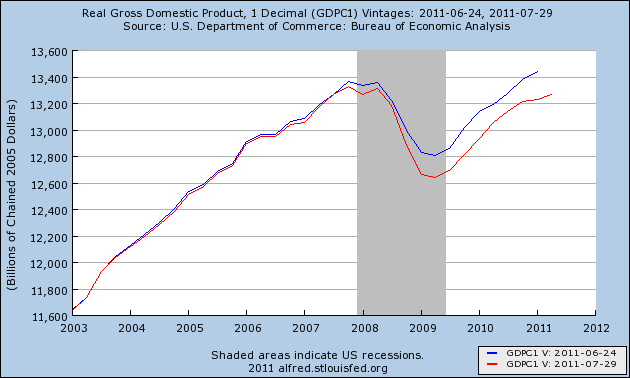

Perhaps this revision of recessions back to 2003 will make the point better - this last Great Recession was deeper than originally thought and the so-called recovery is less than originally thought. It wasn't uncertainty and still isn't - demand plummeted.

#508

Posted 2011-July-30, 12:18

Nonetheless, it seems to me that if the debt ceiling is really unconstitutional the time to have made that argument was before it reached a crisis stage. A spouse may or may not want to sue his partner for divorce because of an adulterous relationship, but if s/he goes to court with such a claim it would seem to me that a counter argument could be that the adulterous relationship has been openly carried on for twenty years, so why is the spouse bring up objections now?

Ok, the debt ceiling is not adultery, even if we are being screwed, but I still think the sudden concern about constitutionality of a long term practice might be a legal point. Otoh, if no bill reaches the president's desk, this could be a different story. I suppose it is straining the analogy but if the adulterous spouse finally goes totally awol, maybe a judge would listen.

I am prepared to acknowledge the somewhat strained nature of the analogy.

#509

Posted 2011-July-30, 12:47

Winstonm, on 2011-July-30, 12:13, said:

Winstonm, on 2011-July-30, 12:13, said:

I would hope that no one seriously buys into this Republican talking point that uncertainty is stalling capital investment - that is a ludicrous claim.

More importantly, American companies are making significant capital investments (and have been for some time)

What they aren't doing is hiring.

Capital investments are generally considered riskier than hiring (its easier to fire an employee than sell a machine) which (pretty much) blows the whole uncertainty argument to pieces.

#510

Posted 2011-July-30, 12:51

The trouble with the analogy is that until now there has never been a debt ceiling problem - the debt ceiling has been used as an excuse for political posturing but it has always been approved and there has never been a doubt that it would be approved. After all, it is simply approval to pay the bill for the amount previously agreed to and already spent.

The fact that there is now a small faction of morons holding guns to our heads and saying they won't write a check until their demands are met means that it is time to call the sheriff and let him deal with it. If it becomes apparent that the sheriff and police negotiators cannot make a deal and time is up, it is then time to call in SWAT and give them orders to shoot to kill.

It is not the fault of the sheriff, the police negotiators or the swat team that the morons got shot.

If the President is forced to use the 14th Amendment argument or something like it to keep us solvent, it will not be his fault. It is his responsibility ultimately.

#511

Posted 2011-July-30, 12:56

hrothgar, on 2011-July-30, 12:47, said:

hrothgar, on 2011-July-30, 12:47, said:

What they aren't doing is hiring.

Capital investments are generally considered riskier than hiring (its easier to fire an employee than sell a machine) which (pretty much) blows the whole uncertainty argument to pieces.

Yes, and to go further most of the capital investment is multinationals expanding overseas, IMO the result of the competitive increase caused by the weak dollar, which is another reason their CI does not created jobs in the U.S.

#512

Posted 2011-July-30, 14:58

Winstonm, on 2011-July-30, 12:13, said:

Winstonm, on 2011-July-30, 12:13, said:

demand for what?

#513

Posted 2011-July-30, 15:45

The lawyers can fight this out if it comes to that. I cling to the hope that our elected representatives can stop embarrassing the country and acknowledge that debts that are due on Wednesday should be paid on Wednesday. If not, then yes, bring on the lawyers.

#514

Posted 2011-July-30, 16:06

luke warm, on 2011-July-30, 14:58, said:

luke warm, on 2011-July-30, 14:58, said:

Stuff.

Demand is what happens when you have more space than you do stuff - then you have to go buy more stuff - unless you don't have any wages, then the stuff just sits on the shelves because you can't buy it.

#515

Posted 2011-August-01, 04:59

Winstonm, on 2011-July-30, 12:13, said:

Winstonm, on 2011-July-30, 12:13, said:

Perhaps this revision of recessions back to 2003 will make the point better - this last Great Recession was deeper than originally thought and the so-called recovery is less than originally thought. It wasn't uncertainty and still isn't - demand plummeted.

Its very unclear what the relationship between uncertainty and capital investment is. It is well established however that economic uncertainty suppresses demand, because consumers save more when their future earnings are uncertain. Lack of demand probably filters into a lack of investment, but it is very hard to say with any certainty.

The recovery from a debt crisis will necessarily mean a prolonged period of reduced demand as consumers pay of their debt down to manageable levels. This is the flip side of the fact that easy credit led to increased growth because demand was increased by people spending money they did not really have.

A different, but equivalent, way of looking at it is to say that the US gdp prior to the crisis was well above its sustainable trend because a large part of that increase was financed by an unsustainable debt path. I think all of the USA/UK sphere is looking at a long period of stagnant demand while consumers reduce their personal debt burden. Ideally government spending could be used to bridge that gap, but no governments are really in a position to take on that much extra spending.

To put it in perspective, US consumer debt is now at its lowest level since 2004, according to some reports (here) which is evidence that money that would normally be financing a bounce back in demand in a normal recession is instead being used as a down payment on debt. I would fully expect this to continue for another one to two years. Excluding morgages, the US consumer holds about $15 trn in personal debt, or about $40,000 per person. That is a lot of paying down to do before one starts buying more stuff again. In fact, the problem is probably even bleaker than that, as most debt seems to be held by young people, who are the prime consumers as older people tend to already have most of what they want and not be too interested in the latest gadgets.

#516

Posted 2011-August-01, 06:19

phil_20686, on 2011-August-01, 04:59, said:

phil_20686, on 2011-August-01, 04:59, said:

The problem of making short term investments to get the economy going again while simultaneously making credible efforts to tackle real long term deficit problems seems intractable. Economists don't agree how to do this. Politicians don't agree how to do this. Voters don't agree how to do this. Even water cooler people don't agree how to do this.

And yet it seems clear to me that getting the economy going again is a big part of a credible strategy for tackling the long term deficit problem and that interest rates for financing infrastructure investments are as attractive as they are ever likely to be.

This is too fubar for me.

#517

Posted 2011-August-01, 06:42

Perhaps it is so, who am I to question a document put out by our government? But I am more than a little skeptical. For example, we often have a credit card "debt" of two to three thousand dollars at some time during the month. That time would be in the few days before it is paid off. If they count this, it is very unrealistic. Using plastic and paying it off at the end of the month is just the way purchases are made these days. But in real terms it is no more of a debt than if I paid cash. Effectively it is paying cash, it is just a matter of how the cash is transferred.

But in a larger sense, I think the debt issue as a drag on the economy is very real. I think that more than a few people have had some real flashes of insight into the danger, make that stupidity, of running up long term credit card debt to buy a lot of crap they don't need.

#518

Posted 2011-August-01, 06:46

y66, on 2011-August-01, 06:19, said:

y66, on 2011-August-01, 06:19, said:

This is too fubar for me.

Or, to quote W.C. Fields, sometimes we just have to take the bull by the tail and face the situation.

#519

Posted 2011-August-01, 06:52

kenberg, on 2011-August-01, 06:42, said:

kenberg, on 2011-August-01, 06:42, said:

If you have a debt of 2000 bugs three days a month that averages to 200 bugs which is what these figures would have to be based on. I agree 40000 sounds incredible.

#520

Posted 2011-August-01, 06:55

kenberg, on 2011-August-01, 06:42, said:

kenberg, on 2011-August-01, 06:42, said:

The following claims that the number is approximately $7,800

http://www.money-zin...ebt-Statistics/

The article that Phil referenced explictly notes that mortages are included in the $13.4 trillion figure

Quote

The fall in 2010 (to $13.4tn) marked the second year in a row total U.S. (household) debt has fallen.

Help

Help